Bill Presentment & Payment Software for Print Services

Expand Revenue & Cash Flow with uPayments by Uluro

Uluro® uPayments is a powerful platform that enables traditional print service providers to complement their existing services with electronic bill presentment and secure payment functionality adding more value to the overall customer offering. Generate and deliver bills automatically across multiple channels using Uluro’s fully integrated bill payment solution that offers complete site branding and security that satisfies the most demanding requirements—all without the need for complex programming. As a standalone solution, uPayments can seamlessly integrate with your current software platform.

With Uluro’s uPayments solution you can:

- Quickly add a user-friendly platform with full-scale EBPP, eBill, EIPP or payment processing capabilities

- Easily send electronic bills, invoices, or notices through your customer’s preferred channel (print, email, text)

- Securely receive payments on your customers’ behalf

- Generate additional revenue for Service Providers

- Enterprises can reduce DSO and streamline the Revenue Cycle Management process

- Set up an application once and deploy it across multiple customers and multiple delivery channels

Optimizing Bill Presentment Solutions with Advanced EBPP Software

In today's digital landscape, bill presentment solutions are essential for businesses looking to optimize their billing processes. Electronic Bill Presentment and Payment (EBPP) software enables companies to present invoices electronically and accept payments through various digital channels, such as web, mobile, and email. Adopting EBPP software helps businesses reduce costs, accelerate payment cycles, and enhance the customer experience with features like multi-channel delivery, real-time notifications, personalized billing, secure payment processing, and automated reconciliation.

Advantages of Advanced Bill Presentment Solutions

Advanced bill presentment solutions offer significant cost reductions by eliminating paper bills and lowering postage and printing expenses. Faster payment cycles are achieved as customers can pay instantly through their preferred channels, improving cash flow. Enhanced customer satisfaction is another major benefit, as seamless and convenient billing experiences boost engagement. Additionally, EBPP software streamlines billing operations from invoice generation to payment collection, increasing efficiency and decision-making capabilities while contributing to environmental sustainability by reducing paper usage.

Selecting the Right EBPP Software

When choosing an EBPP software solution, businesses should prioritize scalability, customization, integration, and cost-effectiveness. A scalable solution grows with your business and handles increasing transaction volumes, while customization options tailor the billing experience. Seamless integration with existing systems like CRM and accounting software ensures smooth operations. Evaluating the total cost of ownership, including setup fees, transaction costs, and maintenance expenses, is crucial. Investing in the right bill presentment solution not only improves billing processes but also enhances the customer experience, setting businesses apart in a competitive market.

uPayment key functionality & benefits:

- Secure PCI Compliant Solution

- Both Credit Card & ACH payments

- Direct Integration to Payment Processor and low rates

- Partial Payments & Over Payments

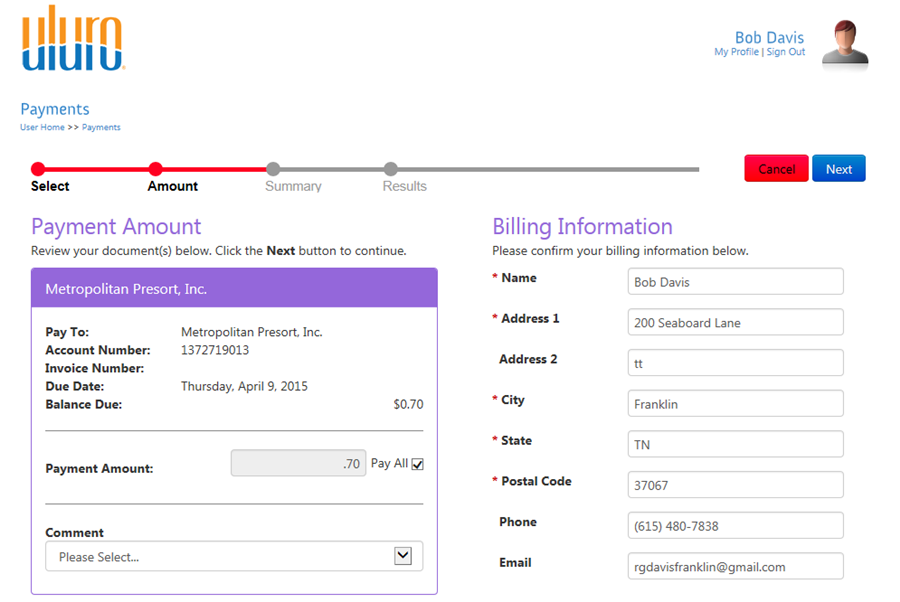

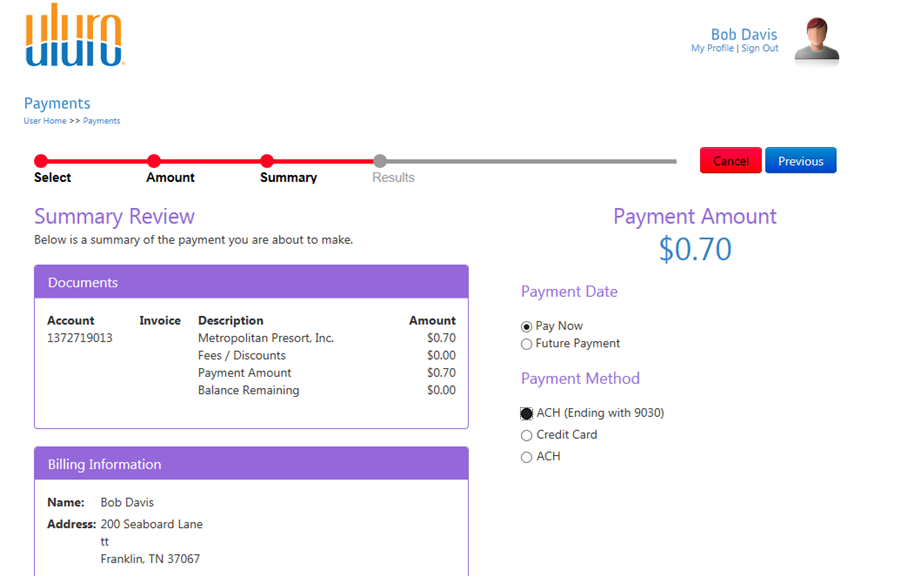

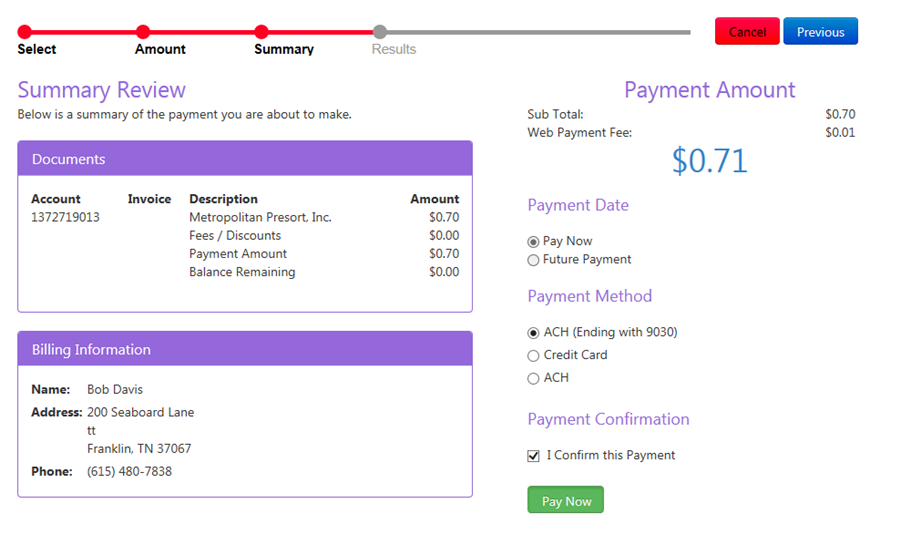

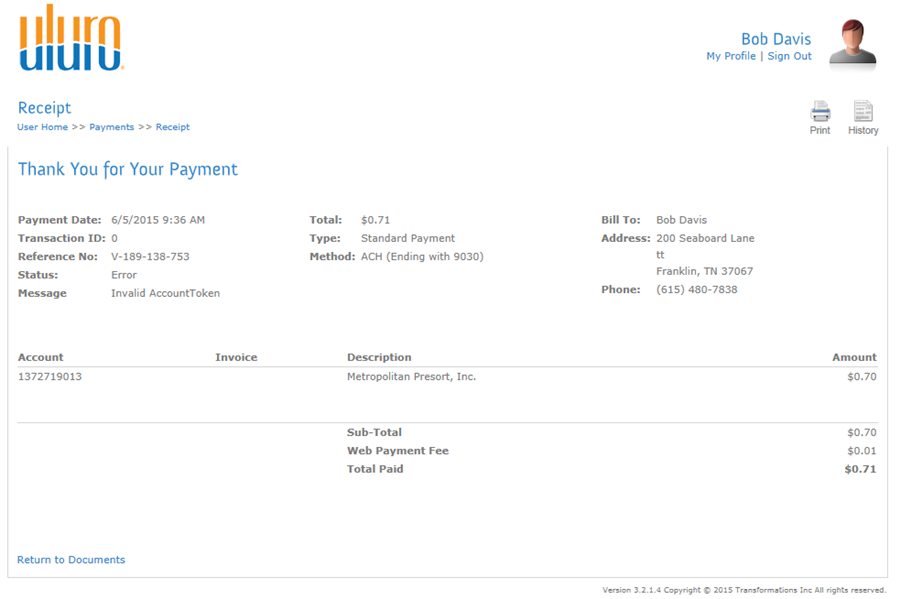

- User-Friendly Payment Interface

- Future Payments & Recurring Payments

- OnceAmation Quick Deployment

- One-Time Guest Payments

- Fast Approvals and structured Onboarding Process

- Convenience Fees and Service Fees

- Extensive Reporting Dashboard

- Payment Late Fees and Discounts

- Collect payments via web mobile, SMS, IVR

- Payment Credits

Security that satisfies the most demanding payment requirements

Uluro’s uPayments integrates directly with multiple Payment Processors such as FIS/Worldpay and First American Payment Systems, eliminating the need for costly gateways and supports the many diverse requirements for B2B and B2C billing. The use of tokenization to securely store credit cards directly with the payment processor and not within the uPayments application provides a PCI compliant solution while providing end-users both the convenience and security they desire.

Complete preference management and integration with the Uluro CCM software platform

Uluro’s uPayments is more than a simple ePresentment solution. It is a powerful ePayment platform that focuses on convenience and end-user preferences (both communication method and billing preference). As a preference management platform, uPayments ensures that every account for a specific client has their preferences linked to it.

Expand your account portfolio with uPayments. When you seamlessly integrate uPayments with your current CCM software modules and services, you can take advantage of an additional revenue stream that can transform your business.

Serving Businesses Across the United States

Uluro takes pride in supporting American businesses from Coast to Coast. We regularly work with companies and businesses from major cities such as Atlanta, GA, Charlotte, NC, Chicago, IL, Chattanooga, TN, Cincinnati, OH, Indianapolis, IN, Jacksonville, FL, Nashville, TN, Louisville, KY, Memphis, TN, New York, NY, and more!

Contact Uluro's payment processing software developers for more information on uPayments and how it can streamline your payment processing.

ARTICLE ON GETTING STARTED WITH EBPP (CLICK HERE)

Combining/Co-mingling

uTrack provides organizations with the ability to take any number of available files and combine them into a single production run, all on demand. Uluro provides the flexibility and capability to achieve production efficiency levels once thought unreachable in the document production process. This efficiency allows for longer production runs, reduced setup times and increased throughput per hour to make the lowest obtainable cost per unit.

Dashboard

Uluro’s dashboard provides informational access to any user with rights for each job and the mail pieces within the job through a Windows-based interface. Clients can track their jobs daily, from file receipt and proofing to production and final delivery to the USPS.

With full mobile and tablet support, the dashboard ensures your sales and customer service staff won’t cause constant production interruptions. An alert feature enables messages to pass through the dashboard regarding status changes and additional job information.

Job Tickets

Uluro allows for the automated creation of a user-defined “job ticket” upon the completion of a client data transmission. This job ticket is the initial document used to trigger the physical production process and follows the job through the entire production process.

Advantages to Job Tickets:

- Custom design a job ticket to contain all relevant information for document processing to help reduce mistakes and increase productivity.

- Job tickets print automatically on a user-defined printer upon file receipt, reducing the need for manual creation and intervention.

- CSR’s can easily update job ticket user-defined fields when job changes (special inserting instructions or material changes) are required, reducing the need for internal IT resources to make such changes.

Barcoding

Uluro can support all of your camera and scanner requirements via the creation and printing of virtually all font-based barcodes. Examples include:

- Production (2 Dimensional (2D) or Matrix): 2D, DataMatrix, QR Code, PDF417

- Postal Specific: Intelligent Mail Barcode (IMB), POSTNET, PLANET

- Production (Linear or 1D): Code 25 (2of5), Code 39 (3of9), Code 128, Codabar

- Other: OMR, OCR

Pull Lists

Uluro allows for various methods in which a client “pull list” (any user-defined grouping of data that requires special handling) can be created and handled accordingly.

- Automated: This method involves an end user identifying specific records to be segmented via a unique data field or business rule. Uluro automatically segments these identified records and creates a separate job file to be handled accordingly within production.

- Web Proof: This method involves an end user identifying specific records to be segmented via a unique data file or business rule. Via the web, the identified records are then provided to the end user prior to production to be analyzed and individually selected for special handling. Records can also be deleted.

Mail Tracking File

Uluro’s SQL backend delivers an amazing internal mail tracking solution that can provide your organization with mail tracking files to suit any custom ADF suite.

Standard:

- JIF

- MRDF

- HAL

- IDF

- IDX

- KIC

These files can be automatically created and submitted to any internal tracking solution. The open database backend makes reporting and tracking integration simple and ensures that all data is easily available when needed.

Tracking files contain names, addresses and other pertinent information for every record that is contained within a file. This tracking file is automatically generated and uploaded from Uluro.

This file can be accessed by intelligent inserters and camera systems when the job is active to ensure that 100% of records are inserted and mailed. Uluro allows you to quickly identify the existence of duplicate, missing and out-of-sequence documents, eliminating the opportunity for those pieces to be erroneously inserted and mailed.

Reporting

Uluro provides several types of standard audit reports before, during and after each job is processed. These include production reports for accounting and quality control, custom reports for end users and postal reports. All reports are generated automatically when the files are processed before reaching the print queue. The reports are then manually selected by the laser operator and printed on demand.

Sampling of Standard Reports includes:

- File Confirmation Report: electronic confirmation for the end user documenting the name of the file(s) sent, the date and time the file(s) was processed, the count provider by the end user, and the count we actually received and processed (if the end-user includes a record count).

- Itemized Submission Report: indicates the number of documents and the total number of multiple pages that were submitted and printed. This report can be automatically faxed or emailed to the end user.

- Bad Address Report: generated during the address cleansing process, our software will catch any incorrect addresses in customer files and will produce a report detailing all addresses that are incorrect or considered undesirable.

- Account Detail Report: a very detailed report that gives the individual’s account ID, account name, and exact dollar amount billed. It also can identify any specific exclusions requested by the client (i.e. any individuals with zero balances or credit balances).

Custom reports can easily be built to meet any additional needs or end-user requirements.

Reprints

Uluro’s Print Select module provides a simple GUI that can identify and locate any document within seconds. Print Select offers multiple solutions in regards to the reprint process:

- Manually generate an individual reprint by selecting the production file and keying in any user-defined unique identifier (i.e. account number, sequence number, name, etc.) located on the document.

- Reprint the entire file as well, or only select a portion of the file that can be segmented by page range, sequence range, account range, tray range, etc.

- Search for individual reprints across multiple print files if you are not sure which file to select for the required reprint.

- Uluro enables integration with external ADF solutions for automating the reprint process via system-generated exception files eliminating the need for manual intervention.

- Production files can be archived in the queue as long as you require.

Tracking

Tracking is at the heart of Uluro. A database record is created for each data file submission in the system. At each transaction point, the database record for the submission changes status and a transaction database record is created.

Uluro’s tracking database control gives you peace of mind, ensuring every transaction and notification point is tracked, managed and available for easy retrieval in the database.

Print Management

In today’s production print environment, having trained staff is never enough. A successful production shop needs a job management system that utilizes technology and advanced tool sets to ensure optimal performance. This is Uluro!

Uluro's secure database is a central location to control print files across one or more sites.

- Security: Advanced security features to control and track access to jobs and print files.

- Grouping: Group via stock, type, weight or form to reduce the number of required paper changes and maximize your production efficiencies.

- Search: Staff can quickly search hundreds or thousands of files to locate the desired job.

- Status: Jobs are automatically marked as completed or printed to lower the chance of double printing.

- Resubmission: Job resubmission is rights-based and tracked in the reporting to ensure tracking of mail piece integrity and stock while reducing duplication chance.

- Queue Depth: Advanced SLA features and job access administration controls can eliminate cherry-picking and ensure high-priority jobs are not overlooked for easy single-stock long-run jobs.

- Access: The system automatically logs out inactive users to prevent unauthorized access to print files and data.

Client & Submission Maintenance

Set your delivery method with a click of a button. Uluro makes switching from hard copy to email to online presentment simple.

- Auto-combine jobs based on defined business rules

- Select the presort method via a simple drop-down selection

- Enter weights and thickness to determine the exact tray and pallet size

- Easily select/call out any outside program written in any language (i.e. PERL) for pre-processing and post-processing. This allows your programmers to continue writing code in the language they prefer and know best.

Automated File Receipt & Data Validation

Uluro completely automates the receipt and pre-processing process without the need for manual intervention.

- Automatically receive data via Secure FTP (FTPS), email or web submission

- Perform data validation audits such as MD5SUM (a digital fingerprint ensuring no file is submitted twice), verifying page length, checking for missing fields, ensuring validity of account ID, confirming dollar balances and calculations and pattern matching

- Send out an automated email notification to selected contracts indicating complete file receipt, specific counts received and accuracy of data, or alert contacts if errors are present

- Upon successful receipt and validation, data files are immediately submitted for online proofing or directly into production if proofing is not required

- Using Uluro’s OnceAmation® technology, an application is set up once and files can be securely transmitted, validated and automatically submitted to production without IT intervention.